Quick Summary

Gold delivered a historic 73.51% performance in India during 2025, outperforming all major asset classes. With expert forecasts pointing to ₹145,000–₹160,000 per 10g in 2026, investors should understand both the catalysts driving prices and the risks ahead.

Gold's Extraordinary 2025: A Year Like No Other

The year 2025 will be remembered as gold's strongest performance in a generation. Indian gold prices surged 73.51%, climbing from approximately ₹80,000 per 10 grams in early January to ₹135,530 by year-end. This extraordinary rally wasn't driven by speculation—it reflected rational market responses to deteriorating macroeconomic conditions, geopolitical tensions, and a fundamental shift in how central banks manage their reserves.

The 2025 Price Rally

Understanding the Rally's Trajectory

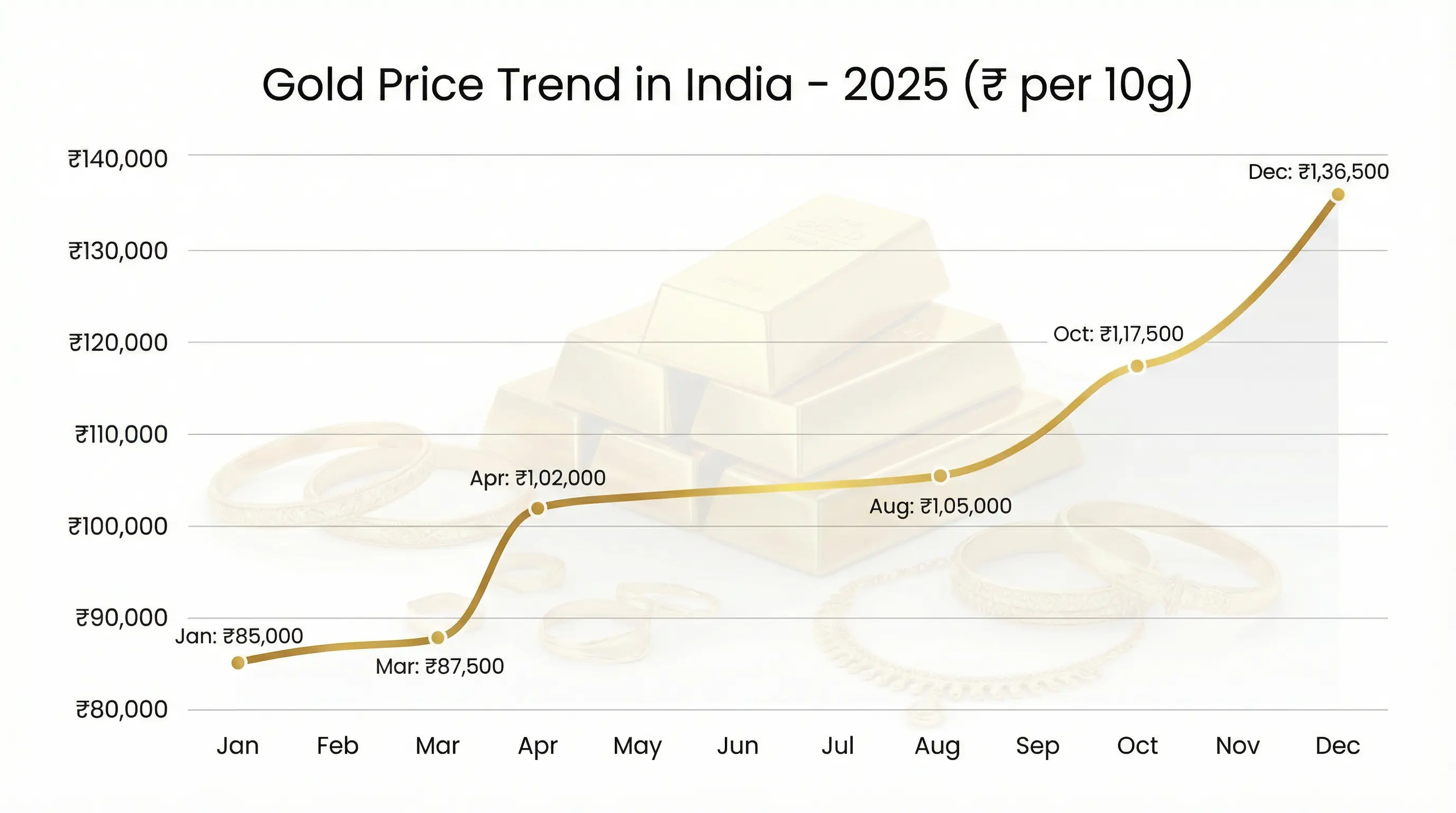

Gold remained relatively stable through the first half of 2025, trading between ₹84,000–₹98,000. However, from July onward, prices entered an accelerating bull market phase:

- January–June: Steady accumulation phase, ranging ₹80,000–₹98,000

- July–August: Breakout phase, crossing ₹99,000 barrier

- September: Acceleration begins, surpassing ₹106,000

- October: Explosive rally reaches ₹118,680 (50% gain YTD)

- November–December: Consolidation at elevated levels, ₹121,000–₹135,530

This rally wasn't characterized by volatility or panic-driven moves. Instead, it reflected measured, sustained institutional buying.

What Drove 2025's Rally

Central Bank Accumulation—A Historic Shift

The most powerful driver of gold prices in 2025 was central bank buying at unprecedented levels. Globally, central banks added 166 tonnes of gold in the first nine months of 2025.

The RBI's Move

India's Reserve Bank increased gold holdings to 880.18 tonnes by September 2025, with the central bank raising gold's share in official reserves from 9% to 14%. Additionally, RBI repatriated 64 tonnes of gold from overseas vaults—a symbolic move reflecting policy shifts toward bringing strategic reserves under domestic control.

A Collapsing Dollar & Lower Interest Rates

Gold posted a strong inverse relationship with the US dollar throughout 2025. As confidence in dollar assets eroded, the currency weakened significantly. Simultaneously, markets priced in expectations of 125 basis points of Federal Reserve rate cuts over 2025–26.

The Impact: Lower interest rates reduce the opportunity cost of holding non-yielding gold, making the metal more attractive relative to bonds.

Investment Demand Explosion Through ETFs

Gold ETFs received ₹2.9 billion in inflows by October 2025—equivalent to 26 tonnes of physical gold. Gold ETF assets under management reached ₹10.9–₹11 billion, with India ranking 7th globally in gold ETF holdings.

Monthly inflows tell the acceleration story:

- September 2025: ₹942 million inflow

- October 2025: ₹850 million inflow

- November-December: Sustained momentum above average

Jewelry Demand Remains Resilient

While higher prices suppressed volume in mass-market jewelry segments, value-based jewelry demand remained robust—particularly during India's busy wedding season. Gold recycling surged 22% in H1 2025 as households capitalized on elevated valuations.

The 2026 Outlook

Expert Forecasts: Bullish Consensus

Heading into 2026, consensus opinion among major global financial institutions is decidedly bullish:

| Institution | 2026 Forecast (USD/oz) | Timeframe |

|---|---|---|

| Goldman Sachs | $4,900 | December 2026 |

| JP Morgan | $5,055 | Q4 2026 |

| Societe Generale | $5,000 | End 2026 |

| Bank of America | $4,438 | 2026 Average |

In Indian Rupees: These forecasts translate to ₹145,000–₹160,000 per 10 grams by end-2026.

The Bullish Case for 2026

Continued Central Bank Diversification

Goldman Sachs estimates central banks will purchase 70 tonnes of gold in 2026, continuing the strategic shift away from dollar-denominated assets.

Limited Mine Supply Growth

Global gold mine production faces regulatory headwinds. Gold supply grows at geological timescales, creating structural imbalance favoring prices.

Investment Flows & ETF Momentum

The ₹2.9 billion ETF inflow in one year demonstrates formalized gold investing has achieved critical mass among younger, digitally native investors.

Key Risks

A Stronger US Dollar

If fiscal discipline improves and interest rates rise unexpectedly, the dollar could strengthen, suppressing gold prices.

Rising Interest Rates

Higher real interest rates directly hurt gold by raising its opportunity cost.

Demand Destruction from Elevated Prices

Jewelry demand has already softened due to high prices, with volume declining 16% year-over-year.

What 2026 Means for Different Investor Types

Conservative Savers

Gold remains compelling for wealth preservation during uncertain times. Consider maintaining or modestly increasing exposure through ETFs or sovereign gold bonds.

Action: Target 5–10% in gold for conservative investors.

Income-Focused Investors

Gold's lack of yield becomes less relevant when yield-bearing alternatives are unattractive. Gold becomes valuable as non-yielding store of value in low-rate environments.

Action: Complement fixed income with 5–8% gold allocation.

Speculative Traders

The potential for gold to reach ₹150,000–₹160,000 by end-2026 offers meaningful upside. Practice disciplined portfolio management.

Action: Use options, futures with strict stop-losses.

Jewelers & Gold Traders

Continued price strength remains a volume headwind. Focus on margin and operational efficiency as volumes likely remain pressured.

Action: Optimize inventory management; emphasize services over volume.

Conclusion

The 2025 gold rally wasn't speculative—it was a rational response to deteriorating macroeconomic conditions, the highest central bank gold buying in modern history, structural de-dollarization trends, and a historic shift in Indian investor behavior toward formalized gold investments.

These forces remain largely in place heading into 2026. Expert consensus forecasts gold trading between $4,400–$5,000 per ounce globally and ₹145,000–₹160,000 per 10 grams in India.

As geopolitical and macro uncertainties persist, gold's status as uncorrelated, government-neutral, and inflation-resistant wealth insurance becomes increasingly valuable.

Key Takeaways for 2026

- Bullish Consensus: Expert forecasts cluster around $4,400–$5,000/oz and ₹145,000–₹160,000/10g

- Structural Drivers: Central bank accumulation, de-dollarization, ETF momentum, and geopolitical risks remain intact

- Risk Management: Monitor dollar strength, interest rate expectations, and geopolitical developments

- Investor Strategy: Conservative investors should maintain 5–10% allocation

- Market Structure: Formalized channels (ETFs, sovereign bonds) provide superior access